Our Features

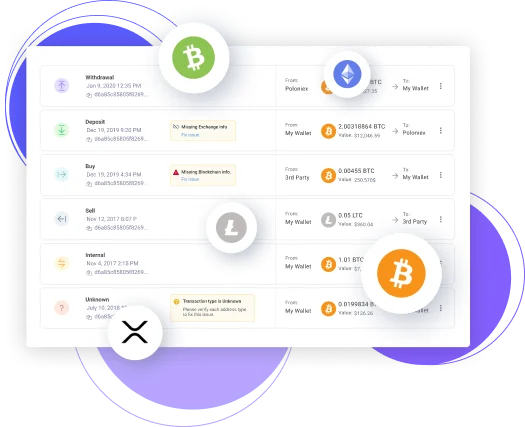

Data Collection and Analysis

- Tracks inventory and assets.

- Sends missing data notifications.

- Authorizes full activity report.

- Tracks, aggregates, and calculates data of multiple blockchains.

- Automatically integrates Exchange and wallet data.

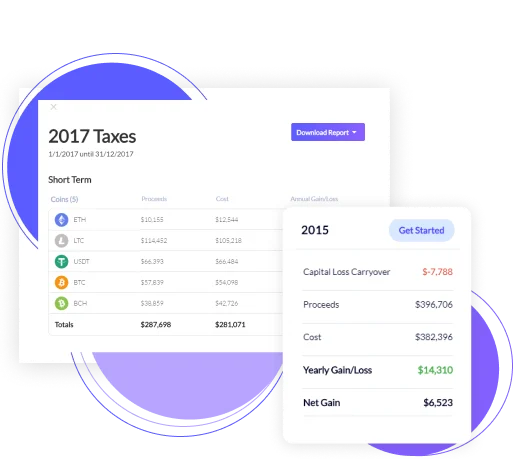

Blockchain-based Crypto Tax Calculation

- Designed for individuals, businesses and CPA firms.

- Extracts all transactions from the blockchain, including real-time data and a comprehensive history.

- Authenticates tax calculations and provides appropriate proof for the IRS.

- Full activity report includes wallets, tokens and exchanges.

- Proprietary algorithm performs crypto-specific identification on the blockchain.

- Optimized Regulation Algorithm (Patent Pending) - Innovative technology provides optimal tax liability & future tax planing.

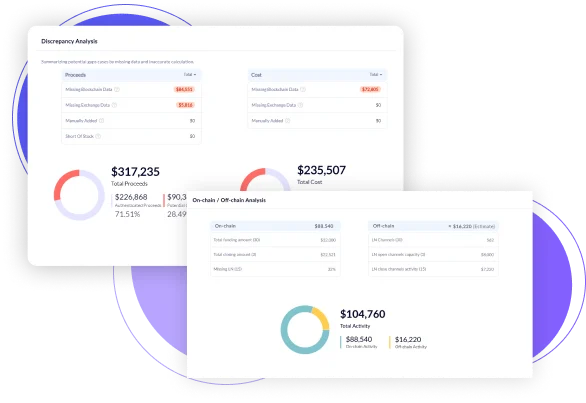

Discrepancy Analysis Report

A detailed discrepancies and missing data analysis graphical report. The report presents all discrepancies, including indications that the taxpayer did not report all his crypto addresses, summary, and evaluation of the missing or inconsistent information.

Blockchain Analysis Algorithms

Building a user's profile based on blockchain analysis. The user profile includes: Automatically add associate addresses, scope of activity, inventory, trades, exchange deposits and withdrawal, third party engagement addresses, crypto holding value, historical transaction value in USD, multi-sig and lightning network transaction, build a separate profile to every suspected third-party address to scoping its activity.